Little Known Facts About Business Capital.

The Basic Principles Of Business Capital

Table of ContentsThe Business Capital IdeasSome Known Questions About Business Capital.4 Simple Techniques For Business CapitalGetting The Business Capital To WorkBusiness Capital Things To Know Before You Get ThisSome Known Details About Business Capital

You may also add more to the equilibrium in your funding account at any moment during the life of your company, and you might likewise take money out of your resources account. There are constraints on just how much you can get of your resources account and also when you can take it, based on the governing records of business.When you start a business as well as desire to take out a bank lending, the financial institution likes to see that you have spent in the company. If the proprietor has no stake in the company, they can stroll away and leave the financial institution holding the bag.

The proprietor pays tax on these dispersed profits through their personal income tax return, and the funding account of each proprietor changes by the amount of the earnings or loss. A corporation pays business earnings tax obligation. Shareholder earnings is tired as resources gains, in two methods: If the investor obtains a dividend, it's thought about a resources gain, which means funding gains tax obligations are due.

What Does Business Capital Do?

Resources accounts can be intricate, as well as due to the fact that each organization scenario is various as well as tax laws are constantly changing, it's best to seek advice from with tax obligation as well as lawful consultants before making any kind of organization choices.

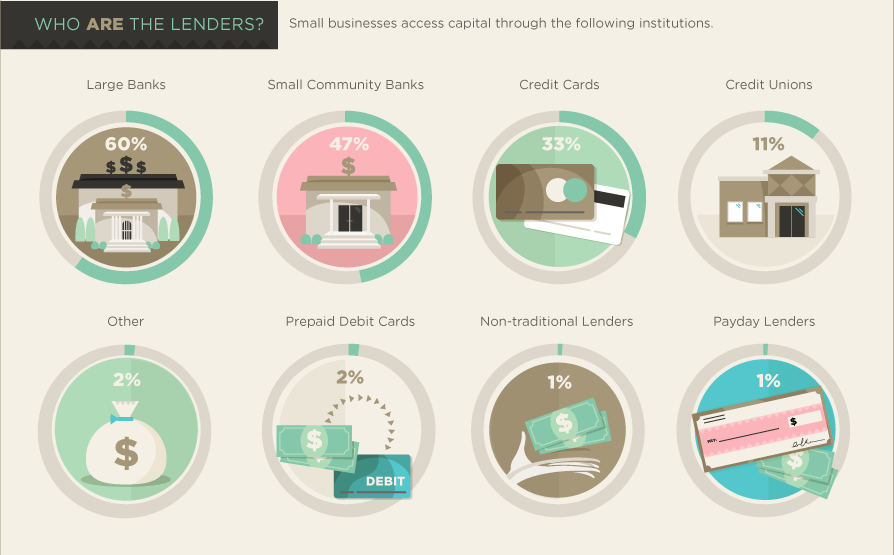

Organizations resource their funding from different sources. Some of the popular resources of funding are stated below: Entrepreneurs typically take small business loan from NBFCs or public financial institutions to resource their resources. Business Capital. This enables them to kickstart their organization as well as buy pertinent machinery for manufacturing. The payment and passions are made with the profits sustained by the company.

Entrepreneurs can welcome capitalists as well as resource their capital from them. Nonetheless, they will have to supply shares of their company to all capitalists depending upon their quantities. Company possessions can be liquidated to source funding. Any kind of disposable or surplus possession like land, tools, etc, can be offered to use the cash as capital for the business.

Get This Report about Business Capital

Productivity is the primary goal of all company ventures. Without earnings business will certainly not survive in the lengthy run. So gauging current and past success as well as forecasting see future earnings is really vital. Profitability is measured with income and also expenditures. Revenue is cash produced from the activities of business.

Cash coming right into the company from tasks like borrowing money do not create income. This is simply a cash purchase between the business and also the loan provider to produce cash for running the organization or getting assets. Expenditures are the price of resources made use of up or taken in by the activities of the organization.

Little Known Questions About Business Capital.

Resources, such as a maker whose useful life is greater than one year are used up over a duration of years. Repayment of a funding is not an expense, it is simply a money transfer between the service and the lender. Success is gauged with an "income statement". This is basically a listing of revenue and costs throughout an amount of website link time (typically a year) for the whole organization.

A Revenue Declaration is traditionally utilized to determine productivity of the business for the past accounting period. A "pro forma earnings declaration" procedures forecasted earnings of the service for the upcoming accountancy duration. A budget plan may be used when you wish to project profitability for a certain task or a section of an organization.

:max_bytes(150000):strip_icc()/WorkingCapitalLoan_Final-c8f87cd151e749fe9eee07612e799e15.png)

More About Business Capital

Generally farmers have utilized the "cash method" of accounting where revenue and also costs are reported on the earnings declaration when products are sold or inputs are paid for. The money approach of accounting, used by most farmers, counts a product as an expense when it is purchased, not when it is made use of in the service.

Nevertheless, numerous non-farm business accounting systems count a thing as a cost only when it is in fact utilized in business tasks. However, take-home pay can be misshaped with the money approach of accountancy by selling greater than two years plants in one year, selling feeder animals purchased in a previous year, and also getting production inputs in the year prior to they are needed.

With this method, earnings is reported when items are read review created (not when they are marketed) and costs are reported when inputs are made use of (not when they are bought). Amassing accounting utilizes the conventional money technique of bookkeeping during the year however includes or deducts supplies of ranch products as well as manufacturing inputs handy at the beginning and ending of the year.

8 Simple Techniques For Business Capital

Commonly, ranch earnings have actually been computed by using "accounting profits". To understand bookkeeping profits, consider your income tax return. Your Schedule F gives a listing of your taxed earnings as well as deductible costs. These coincide things made use of in computing audit revenues. Your tax obligation statement might not provide you an accurate photo of success due to Internal revenue service fast depreciation and also various other variables.

If you were not farming, you would have your cash invested somewhere else and also be utilized in a various career. Possibility cost is the financial investment returns given up by not having your cash spent somewhere else and also salaries quit by not working somewhere else. These are reasoned, along with average overhead, in computing economic revenue.